Track Record

The track record of the SmallCap Informer newsletter continues to demonstrate a market-beating edge in stock newsletter ratings.

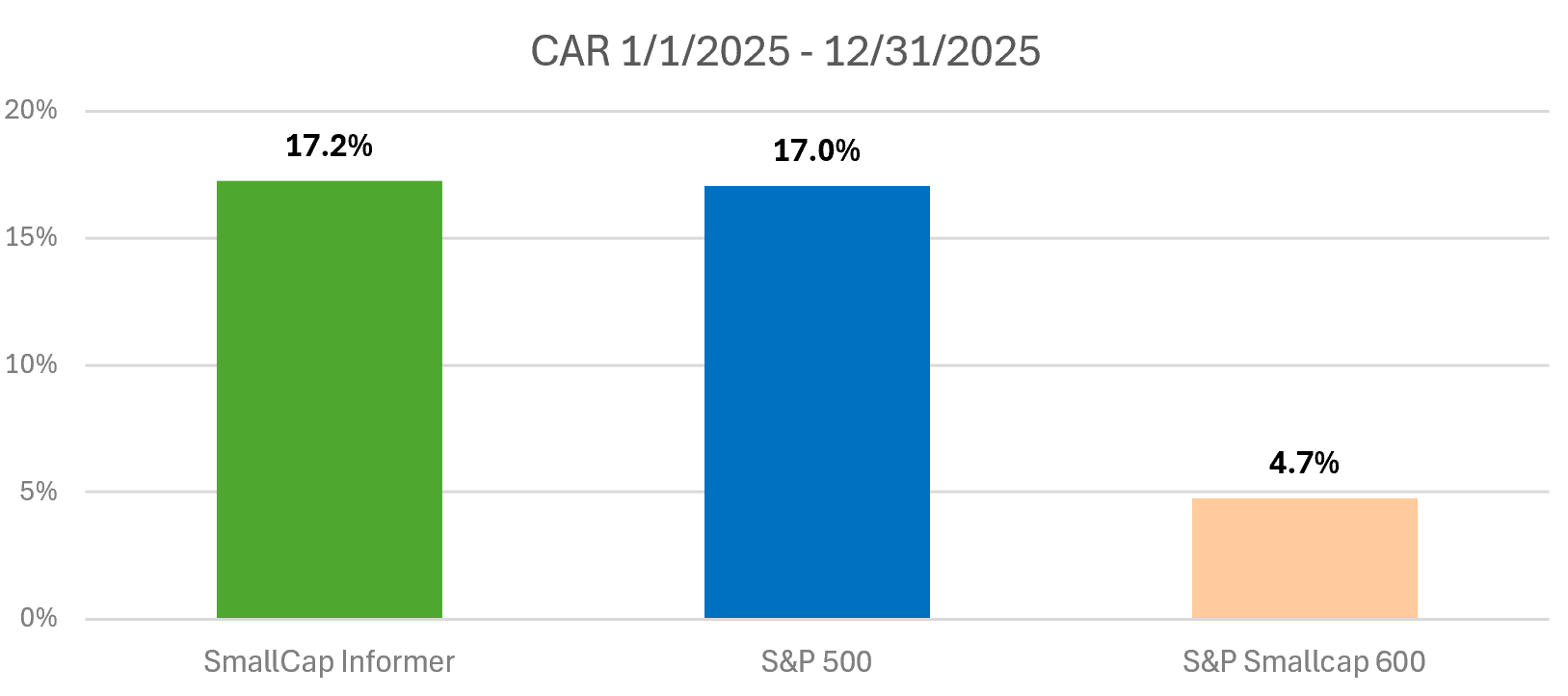

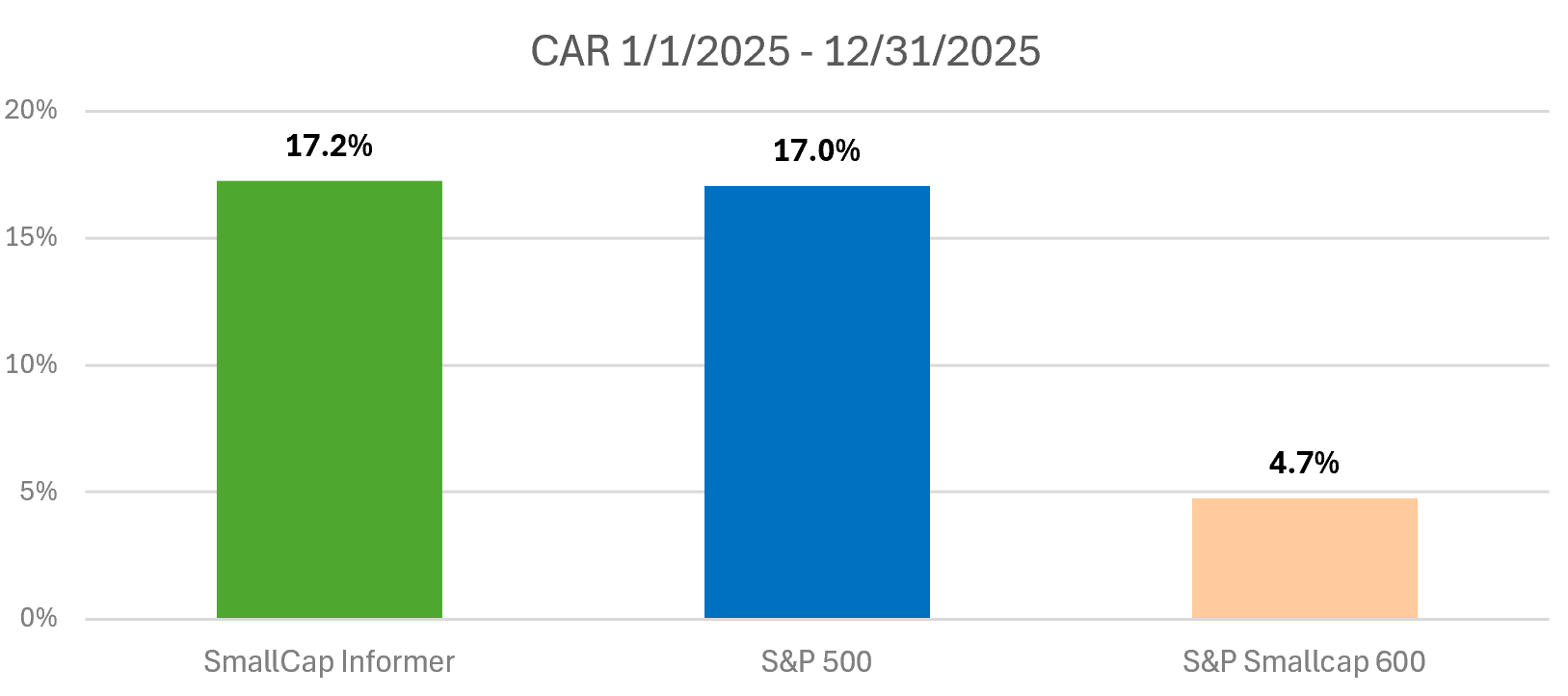

In 2025, most impressively, the SmallCap Informer outpaced the 17.0% benchmarked rate of return for the S&P 500. This is a rare feat in the mega-cap dominated market of the last several years. SCI has beaten the broad market previously, most recently in 2023 when our return reached 26.8% compared to the S&P 500’s benchmarked 26.24%.

Compared to the S&P Small-Cap 600 Index, the SmallCap Informer's stock picks have outperformed in the lifetime of the newsletter and for every other period calculated. The following benchmark graph compares the compound annual return (CAR) of the SCI picks to the S&P SmallCap 600 Index:

Lifetime figures begin August 16, 2012. Annual performance figures are for the periods ending December 31, 2025.

Subscribe Today!

Call 1.877.334.2582 or subscribe online. For a limited time, use Promo Code CHARTER99 and save on a subscription!

BetterInvesting and StockCentral Members Save Even More. Call 1.877.334.2582 for Your Special Discount.

Notes on Performance Calculations

We calculate performance using industry-standard compound annual return (CAR) formulas that consider the cash flows of all buy recommendations, sell recommendations, and dividends.

Each focus stock is recorded as a purchase in equal amounts using the closing share price on the next business day following the publication date.

Sell recommendations are recorded using the closing share price on the next business day following the publication date of the email alert (if sent) or the publication date of the issue that includes the sell recommendation.

Comparisons to benchmark indexes are made using hypothetical purchases and sales of the index in the same amount and on the same date as the underlying security transactions, then calculating the compound annual rate of return of those index transactions. Because multiple cash flows are utilized, the rate of return for an index may not match the simple rate of return that is calculated by other sources using the index value at the start and end of a particular period.

Our target benchmark is the S&P SmallCap 600 Index. Many small-cap newsletters compare their results to the Russell 2000 index, however the Russell 2000 tracks many companies that are much, much larger by market cap than our selections and contains many unprofitable companies, making it a less representative index of quality small-cap stocks. The S&P SmallCap 600, however, tracks companies that are largely profitable and better fit the size definition used in the

SmallCap Informer.

The

SmallCap Informer does not include a model portfolio. Our stock selections are meant to be an aid for subscribers to provide them with deep research into candidates that can be held in a long-term focused portfolio. Subscribers are expected to manage their own portfolios and make their own buy/sell decisions about stocks presented in the newsletter. Our performance tracking thus does not represent a real-world/real-money portfolio but it intended to capture the overall typical performance of the companies presented in the newsletter.